This post may contain affiliate links, and Sweet Lyfe Daily may earn a small commission from purchases made through link at no additional cost to you. As an Amazon Associate Partner, Sweet Lyfe Daily may earn a commission from qualifying purchases. Please do your own research before making any purchases. Please click to read our full Disclaimer. Thank you for your support.

Dear Sweet Friends,

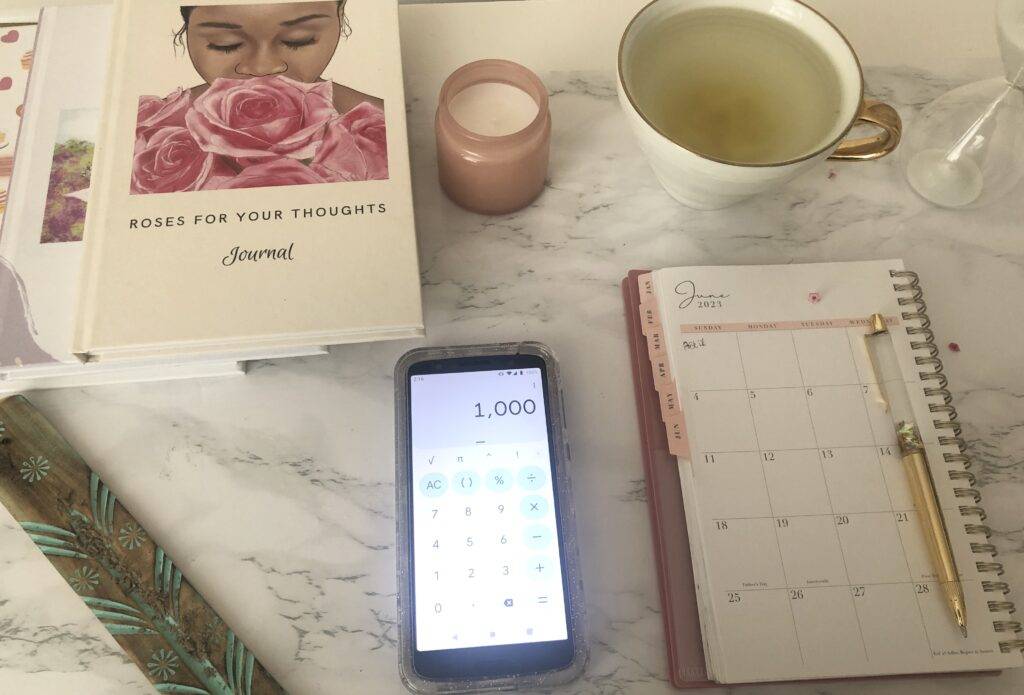

Here are some money lessons and hacks I have learned throughout the years that still serves me today. In this post, I will share the money hacks and lessons and provide the context in which I learned and adopted these lessons and hacks.

1. Living within your means

This is a lesson I learned from watching my parents and the specific advice they offered me as a young adult. After graduating and getting my first job (a temp job), I operated on the mindset of treating myself because I deserved it. My favorite vice was shoes, so I would treat myself to a pair of shoes almost every month. I had just moved back to New York City and returned to living with my parents while I adjusted to my post-graduate life and a new job. Upon observing my shopping behavior, my parents sat me down for a chat.

My mother suggested I save money from every paycheck, no matter how small. She introduced me to mutual funds and suggested I start investing in one since the temp agencies did not offer retirement plans. She suggested investing at least $50 per month into this fund.

On the other hand, my dad offered me a formula/strategy for saving money. He advised me to be mindful of lifestyle creep. He suggested that every time I receive a pay increase, whether from working overtime or a bonus, I should assess whether I was living comfortably before that pay increase or bonus. He said if I was enjoying life and living comfortably before the pay increase, I should save whatever bonus or increase I received. He advised me to be mindful that I do not adjust my lifestyle to the pay raise or bonus but rather scrutinize my need for more things because I have this additional money.

This advice resulted in me saving over 60% or more of my income while living in New York City. I rented my own apartment, enjoyed traveling and eating out with friends/family, so as you can see, this advice did not result in deprivation. My parents’ advice to invest, save and avoid lifestyle creep served me tremendously. It helped me to stay afloat and endure unemployment while living in New York City. I was able to save an emergency fund prior to being laid off, which helped decrease the stress and cushion the impact of such an event.

The mutual fund my mother suggested was the gateway to eventually investing in companies’ 401K, where I maximized by investing up to the company’s match and also invested in an IRA. I will always cherish these pieces of advice and continue to apply them because I have witnessed the effectiveness of both.

2. Operate like a squirrel

This money lesson still makes me smile and goes hand in hand with the lifestyle creep lesson above. This lesson was imparted to me by an older coworker during the 2008 financial markets crisis. My coworker was near retirement and was stunned to see how many younger workers were left financially and emotionally devastated by the 2008 financial market crisis.

He stated that his parents taught him that he should operate like a squirrel during economic and financial prosperity. I was confused by this comment and asked him to explain. He said just before the winter season, squirrels gather as much food as they need and store them because they understand once the winter season hits, they may not have access to this abundance. He stated that many of us, and he pointed to our coworkers, can take a lesson or two from squirrels.

I witnessed this firsthand and applied this lesson to how I looked at and navigated working and saving. I understood how it felt to experience a layoff. I observed how devastating it is when you don’t operate like a squirrel during seasons of abundance. The act of gathering and storing money and other resources away during times of abundance can help alleviate anxiety and stress during financial and economic uncertainties.

3. Don’t lend what you can’t afford to lose

Once I graduated and started to work, I was definitely a target for borrowers. People approaching me to borrow money became so frequent that I began writing loan agreements and promissory notes for them to sign. I was single, making a decent amount of money. To them, I was successful based on my educational degree and the institutions I worked for. My personal responsibility, in this case, is that I wanted to help others, so both rationales collided. I quickly learned not to lend what I could not afford to lose.

Much of the money I loaned was either never repaid or involved me chasing individuals for repayment, which bred resentment. After multiple experiences like this, I decided I would stop lending money. If anyone approached me to borrow money, I would offer it to them as a gift and not a loan. I let them know outright I do not lend money. I also made sure I did not overextend myself with these gifts. This money lesson alleviated my resentment, and people are now well aware of my boundaries regarding lending money.

4. My Crowd-fund hack

As I stated earlier, I was the go-to person for borrowing money. As I continued to be approached by borrowers, one hack or tactic I employed was to suggest to the borrower that they ask multiple individuals for a smaller amount of money versus one person (me) for the lump sum. This hack came about after a friend asked me to borrow $500. This friend came from a large family, with siblings and many aunts, uncles, cousins, and friends.

However, she only approached me for this “loan.” I told her I could only afford to give her $100. I suggested she contact other family members and friends to make up the difference by asking each person for $50 or less. I told her many people are more likely to lend a smaller increment versus the large sum she sought. This is a money lesson I have employed since then. I gave what I felt comfortable giving, understanding I may never be repaid. I offered my friend an alternative and reasonable solution to getting the rest of the money she needed.

5. Bi-weekly loan payments

I found out about this hack through a coworker. One day I overheard her on the phone with her student loan servicing company; she was furious about the misapplication of payments the loan servicing company made towards her student loans. She told me that she paid her student loans and mortgage twice monthly, which reduced the accumulated interest and the life of the loan. I was like, what? So she did the math, and it blew my mind.

I felt like this hack was the “secret sauce” only known by a few people, and I made it my business to share it with as many people as possible going forward. This money lesson was priceless! If you want to understand how this hack works, check out this article.

5. Paying off my credit card balance.

Paying off my credit card balance in full before the due date was a hack and money lesson I realized on my own. This hack helps to reduce or avoid the accumulated interest on your credit card bill. While employed, I used my credit cards to build my credit history, so I only purchased what I knew I could pay off at the end of each month. This hack has saved me a lot of money in interest payments, and I continue to follow this hack to this day. Here is an article that explains how this works.

6. Set aside money for fun and peace of mind

Setting aside money for fun is a financial behavior I seemingly always adopted and promised myself upon graduating. It’s a money lesson that helped me to counter financial stress and fatigue that came with trying to pay down my enormous student loan debt. It allowed me to experience some fun while still tending to this debt.

I knew repaying my student loans would require me to work hard and long, so I knew I personally needed to offset this with fun. So as soon as I got my first permanent job, I set up my “fun account,” an account where I scheduled a certain amount of money to be direct-deposited every month for travel and other fun activities. My accountant also advised me to have what he called an “expletive” account, but I called it my “peace of mind” account.

He shared with me how stressed he felt going to work at a job he did not like. He felt tethered to this job and thought it would be irresponsible to get up and quit without another job or another form of income lined up. His job was having a significant and negative impact on his physical and mental well-being. He shared that he decided his only way out was to start his own business. So he opened up his “expletive” account and put away as much money as possible.

He said opening up this account really changed how he related to work. He did not feel as anxious because he felt empowered and knew the money he saved would allow him to quit his job responsibly. And so I applied my accountant’s advice; I opened up my “peace of mind” account, which held my emergency fund. I, too, found knowing that I had this money alleviated some of the stress and job insecurities in an overall stressful and sometimes toxic job environment. Knowing that I saved enough money, which allowed me to take time off between jobs or outright quit when the position became too toxic, shifted how I related to work.

So there, Sweet Friends, these are my 6 money lessons and hacks that still serve me as an adult.

Have a wonderful day!

Sweet Lyfe Daily

How about you? What money lessons or hacks still serve you to this day? Please share in the comments.