This post may contain affiliate links, and Sweet Lyfe Daily may earn a small commission from purchases made through link at no additional cost to you. As an Amazon Associate Partner, Sweet Lyfe Daily may earn a commission from qualifying purchases. Please do your own research before making any purchases. Please click to read our full Disclaimer. Thank you for your support.

Dear Sweet Friends,

The media reports about the state of the economy, which these days are mostly doom and gloom, have tremendously impacted my financial stress and money anxiety. So today, I wanted to share with you some tools and practices I have been using to manage amidst these economic uncertainties.

So, where do I start?

Money Anxiety paid me a visit this last year; let me tell you, it was not pretty! This visit sent my financial stress up to an all-time high. It started with what I would describe as quiet knocks on the door, appearing in the form of increases in my basic expenses. My grocery budget ballooned, and I received notices from various providers stating they were raising their prices. First, it was my rent, then the electricity, gas, and telephone followed closely. Finally, my internet provider didn’t even bother with a notice. I read the notices, but without numbers attributed to these upcoming increases, I did not react.

A Few Months Later

The knocking got louder as the months proceeded. Finally, I noticed that my allotted budget no longer accommodated my monthly expenses, such as rent, groceries, and utilities. My budget was stretched to the limit and barely covered my basic needs.

Finally, the loud knocking was replaced with one loud crash, and the next thing I knew, the door was off the hinge. Money Anxiety kicked in my door and put me in a tight grip. The light tap on the door had progressively gotten louder throughout these months, and I admit I ignored it. I figured I just had to do what I had to do with what I had. However, in March, I saw that my budget was no longer practical and sustainable. This realization fueled Money Anxiety to settle in rent-free.

Financial Stress and Money Anxiety is real

I always thought I had a good relationship with money. I saved, spent within my means, and always put a little aside for some fun. Still, the last few years have challenged my budgeting, money management skills, and recently my mental health. Money Anxiety circled like a debt collector who finally located its elusive target.

The media continues to report record-high inflation. They are telling us there is an impending recession. I don’t know about you, but my reality is that whatever technical formulas they want to use to measure recession and inflation, the fact is that my pocketbook is the only expert on these topics. What I am experiencing and feeling is the only data I need to understand the impact of “Inflation and impending recession” on my household and mental health.

Too often, we focus on these technical terms we hear circulating in the media and invalidate our real-life experiences. In this case, the real-life financial stressors. Only you can assess your money situation. The impact of Recession and Inflation are not created equal for everyone. Financial stress is an individual experience, and only you can know when it has taken hold and impacting you negatively.

Reality Check

So how did I start the process of managing my financial stress? I started by shutting out the noise and acknowledging my personal financial stress and money anxiety. This was key to beginning the process of reducing my financial stress and money anxiety. My lighter and much thinner pocketbook was my “consumer price index indicator.” It was my reality check and confirmation that my financial situation had shifted, and I needed to adjust and adapt. Also, coming to the realization that sitting in worry and stress was not the answer. I am not saying to dismiss all the reports on the economy, but what I am saying is to validate your individual experience and take action in response to it. So here is what I’ve been doing about Money Anxiety existing rent-free in my life.

Prioritizing mental health

First and Foremost, I decided to prioritize and tend to my mental health by engaging in exercises and practices that provided me clarity, perspective, and empowerment to navigate and overcome my Financial Stress and Money Anxiety. In addition to taking the typical recession-proofing steps such as scrutinizing my budget, adjusting my spending, securing my emergency fund, keeping my network active, and putting some financial goals on hold.

Here are some practices I have used in the past few months that have been valuable tools in my Mental Health Kit and helped me reduce my financial stress and money anxiety.

Getting My Mind Right

Whenever I am stressed and anxious, I find that journaling helps me to gain clarity and perspective. For example, while journaling about my financial stress and anxiety, I realized a recurring theme: I came from a place of lack. As I stated earlier, I thought I had a good relationship with money, but really digging deep into what was triggering my financial stress and money anxiety made me realize that I was working from a “Lack Mindset,” which may have been lying dormant until now.

Now that I am aware of this mindset, I am taking steps to work through the limiting thoughts and emotions. I started by practicing gratitude and taking stock of all the good things happening in my life daily. I made a game of it by listing 2 to 3 things I am grateful for daily. The game’s goal is not to repeat any one thing I listed previously. Finding something to be thankful for each day has helped me gain perspective. Each day I take some time to slow down and really appreciate and focus on the things I have right here and now.

I became intentional in my effort to find joy and gratitude in the smallest things, I see and experience each and every day rather than dwell on these life stressors. I set an intention each day to counter these life stressors by being mindful of what is going right for me instead of what is going wrong. Of course, some days can be more challenging than others. Still, this practice has been a valuable tool in helping me to get my mind right while dealing with my stress and anxiety. I welcome you to try it out.

Minding My Own Business

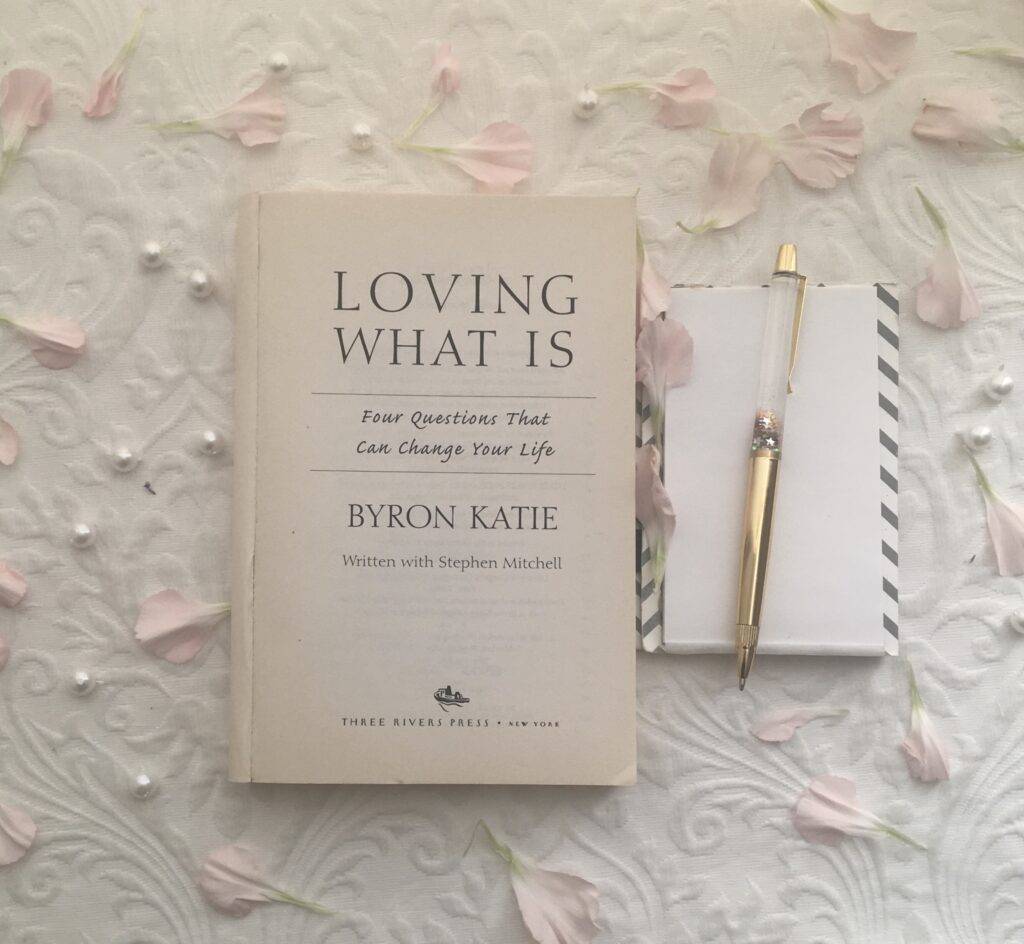

Another tool I use when faced with certain stress or anxiety-driven situations is identifying what is feeding or driving my stress and anxiety. So, I ask myself these questions: whose business am I in mentally? Is it my business, someone else’s business, or God’s business (things outside my control like earthquakes and floods…)? I first came across these questions in Byron Katie’s book “Loving What is” several years ago. I have used it to gain clarity and perspective during stressful times.

Byron Katie stated: “Much of our stress comes from mentally living out of our own business. I can find 3 kinds of business in the universe: mine, yours, and God’s. (For me, the word God means “reality”). Reality is God because it rules. Anything out of my control, your control, and everyone else’s control – I call that God’s business. To think I know what’s best for anyone else is to be out of my business. Being mentally in your business and God’s business keeps me from being present in my own. “

By nature, my brain is wired to solve problems and search for solutions. I always view this as a great quality to have because I enjoy the process of helping others find solutions to their problems. Still, this quality sometimes lends itself to minding other people’s business at the expense of neglecting my own business.

At the onset of this anxiety, I grabbed my journal to tackle these questions. One of the main culprits that distracted me from minding my own business was what I was consuming in the media, both traditional and social media. It’s difficult to avoid the media loop of bad news about the economy and financial woes others are experiencing. This 24/7 news cycle can be too much. Consuming this type of content had me mentally in other people’s business.

So, I have made the decision to reduce my consumption. Instead of sitting down to listen to 30 minutes of morning or nightly news, I spend 5 minutes reading a daily newsletter that addresses current events. I also reduced the consumption of this content on social media. You will be surprised how reducing the consumption of this type of content can do wonders for your mental health. You get the best of both worlds when you set some boundaries around this type of consumption; you get enough news to keep you in the know but not compound your anxiety. It also gives you the time and space to spend on your business.

Focus on what’s in my control

The next tool I have in my Mental Health Kit is, focusing on what’s in my control, which goes hand in hand with “Minding Your Own Business.”

Asking myself when anxiety comes knocking whether the situation that has triggered it is in my control gives me additional perspective. For instance, the Federal government raising interest rates, and therefore the mortgage rates are going up, and I was planning to buy a home. What is not in my control is the Federal government raising the interest rate; what is in my control is sitting down and analyzing my individual situation and seeing how I can make becoming a homeowner a reality. I make it sound simple, and I know it’s not, but try this approach with smaller things in your life. Ask yourself, is this in my control? Can I do anything about it right here and right now? My home-ownership dream is on hold at the moment but I know it will be a reality in the future and this exercise helped me to see that!

Managing My Fears

Whenever fear surfaces and I cannot seem to let it go, I engage in an exercise where I identify and write out my fears. This exercise helps me to analyze my fears to determine if they are rational or irrational, it then prompts me to write-out actions I can take to address my concerns and worries instead of ruminating on them. It prompts me to answer questions such as, what’s the worst that can happen? And if it happens, what can I do about it? What are my options? Here is a sample worksheet that I use to analyze and address my fears.

Tap into or set up a support system

Lastly, I sought out support and talked it out. Talking about financial stress and money anxiety can be uncomfortable, so only you know what you need. I am using a combination of a mental health professional and the tools I detailed above to help me through this season of money anxiety and financial stress. Sometimes trying to manage your Money Anxiety alone has its limitation.

Talking about what is triggering my financial stress and money anxiety helps me. I choose to do this with a mental health professional; it allows me to get outside my thoughts and share my struggles and concerns with a neutral individual. So, seeking the help of a mental health professional is one tool I have in my kit to combat Financial Stress and Money Anxiety. There are now many ways to access mental health professionals, even in the comfort of your own home. If you are not ready to invest in a mental professional, in that case, you can tap into other members of your support system, a trusted friend(s), your family, or a spiritual advisor.

Have a wonderful day!

Sweet Lyfe Daily

Comment below how you are managing your financial stress and money anxiety

This was a great read! I will surely take these tips and apply it to my routine. Thanks for the book recommendation I will add it to my reading list.

Thank you! So happy this was helpful.